CBSE Class 12 Accounts Exam 2023: This article is devoted to the Class 12 Accountancy CBSE exam 2023. As per the details released by the Central Board of Secondary Education (CBSE), the exam for Class 12 Accountancy is planned for 31st March 2023. The day would be Friday. Well if haven’t started your preparations yet, you got the time now. Accounts or accountancy is the subject of the commerce stream. The subject is complex and requires calculations along with long balance sheets. As the subject belongs to the calculation domain the practice for the same is a must. The more you practice the faster you will get in solving the paper within the given time. The paper code for CBSE Class 12 accountancy would be 055 and the duration to solve the question paper will be 3 hours. The Accountancy exam will be for 80 marks.

To check the level of their preparation and get completely ready for their upcoming CBSE Accountancy exam students are advised to solve the below-mentioned questions. These questions are important from the exam point of view and comprise MCQs, Case study-based, and Hypothetical scenario-based questions. The solutions are given along with the questions.

Important questions for Class 12 Accountancy

Question 1:

Read the hypothetical text and answer the following questions.

A, B, and C are partners in a firm. Their capitals are ₹ 30,000, ₹ 20,000, and ₹ 10,000 respectively. As per the partnership deed,

- i) C is to be allowed remuneration of ₹ 3,000 p.a.

- ii) Interest on capital @ 5% p.a.

iii) Profits should be distributed in the ratio of 2:2:1.

Ignoring the above terms, a net profit of ₹ 18,000 was distributed among the partners equally.

Q1. How much interest on capital is to be credited to partner A?

a) ₹ 1,500

b) ₹ 1,000

c) ₹ 900

d) ₹ 800

Ans: b) ₹ 1,000

Q2. How much profit is to be credited to Partner B after all adjustments?

a) ₹ 2,400

b) ₹ 4,800

c) ₹ 1,000

d) ₹ 1,200

Ans:c) ₹ 1,000

Q3. What is the total profit to be credited to A, B, and C after all adjustments?

a) ₹ 12,000

b) ₹ 8,000

c) ₹ 9,000

d) ₹ 10,000

Ans:c) ₹ 9,000

Q4. What is the amount of the past adjustment entry?

a) ₹ 350

b) ₹ 450

c) ₹ 250

d) ₹ 55

Ans:c) ₹ 250

Question 2:

Karthik and Amit were partners in a firm carrying on a tiffin service in Delhi. Karthik noticed that a lot of food is left at the end of the day. To avoid wastage he suggested that it can be distributed to the needy, Amit wanted that it should be mixed with the food being served the next day. Amit then proposed that if his share in the profit increased, he would not mind the free distribution of leftover food. Karthik happily agreed. So, they decided to change their profit-sharing ratio to 1:2 with immediate effect. On that date, a revaluation of assets and reassessment of liabilities was carried out that resulted into a gain of Rs.36,000 On that date the goodwill of the firm was valued at Rs.2,40,000

- Sacrifice/gain of Karthik and Amit will be

Ans: Karthik sacrifice 1/6, Amit gains 1/6

- At the time of change in profit sharing ratio, gaining partner’s capital a/c is——– and sac-

rificing partner’s capital a/c is —————– for adjustment of goodwill

Ans: debited, credited

- Pass the journal entry for adjustment of goodwill

Ans: Amit’s capital A/c Dr 40,000

To Karthik’s capital A/c 40,000

Question 3:

Read the hypothetical text and answer the following questions.

Arun, Varun, and Tarun were partners in firm sharing profits equally. On 1st April, 2020, their capitals stood at ₹ 2, 00,000, ₹ 1, 50,000 and ₹ 1, 00,000 respectively. As per the provisions of the Partnership Deed:

1) Arun was entitled to a salary of ₹ 2,500 p.m.

2) Partners were entitled to interest on capital @ 10% p.a.

The net profit for the year ended 31st March 2021, ₹ 1, 50,000 were distributed among the partners without providing for the above items.

Q1. What is the amount of interest on capital Varun?

a) ₹ 20,000

b) ₹ 15,000

c) ₹ 10,000

d) ₹ 30,000

Ans: a) ₹ 20,000

Q2. What is the amount of distributable profit for the partners after providing salary and

interest on capital to the partners?

a) ₹ 50,000 each

b) ₹ 25,000 each

c) ₹ 10,000 each

d) ₹ 15,000 each

Ans: b) ₹ 25,000 each

Q3. Arun’s Capital A/c will be credited with Rs…………….for giving the adjustment to

the above omissions.

a) Rs 20,000

b) Rs15,000

c) Rs 25,000

d) Rs10,000

Ans: c) Rs 25,000

Q4. Capital Account/Accounts of …………………… will be debited to give the effect of

the above adjustments.

a) Varun

b) Tarun and Arun

c) Arun and Varun

d) Varun and Tarun

Ans: d) Varun and Tarun

Question 4:

A, B and C are partners sharing profits and losses in the ratio of 5:3:2. A was unable to devote time to business due to her other commitments. Therefore adjustments were required in the agreed terms of partnership. They decided to share future profits and losses in the ratio of 2:3:5. With effect from 1st April,2021.The values of assets and liabilities did not require any adjustments. However, an unrecorded computer of value Rs.60,000 and a claim of a customer of Rs.30,000 was to be brought in the books. The balance sheet has goodwill of Rs.10,000 as an asset, other assets(excluding goodwill were Rs.6,00,000 whereas liabilities were Rs.50,000. Normal rate of return is 15% and average profit is Rs.90,000.

- Calculate Goodwill under capitalisation of average profit will be

Ans: Rs.20,000

- Calculate Sacrificing and gaining ratio of the partners

Ans: A-3/10 (sacrifice), B-nil, C-3/10(gain)

- Who is neither a gaining nor a sacrificing partner

Ans: Person B

Question 5:

Sanjana and Alok were partners in a firm sharing profits and losses in the ratio 3 : 2. On 31st March 2018 their Balance Sheet was as follows:

|

Liabilities |

Amount(`) |

Assets |

Amount(`) |

|

Creditors |

60,000 |

Cash |

1,66,000 |

|

Workmen’s Compensation |

|||

|

Fund |

60,000 |

Debtors 1,46,000 |

|

|

Less: Provision for doubtful debts 2,000 |

1.44.000 |

||

|

Capitals: Sanjana 5,00,000 Alok 4,00,000 |

9,00,000 |

Stock |

1,50,000 |

|

Investments |

2,60,000 |

||

|

Furniture |

3,00,000 |

||

|

10,20,000 |

10,20,000 |

On 1st April 2018, they admitted Nidhi as a new partner for 1/4th share in the profits on the

following terms :

(a) Goodwill of the firm was valued at ` 4,00,000 and Nidhi brought the necessary amount in cash for her share of goodwill premium, half of which was withdrawn by the old partners.

(b) Stock was to be increased by 20% and furniture was to be reduced to 90%.

(c) Investments were to be valued at `3,00,000. Alok took over investments at this value.

(d) Nidhi brought ` 3,00,000 as her capital and the capitals of Sanjana and Alokwere adjusted in the new profit sharing ratio.

Prepare Revaluation Account, Partners Capital Accounts and the Balance Sheet of there-

constituted firm on Nidhi’s admission.

Ans: Revaluation profit- Sanjana:24000 Alok:16000;Capital Balances -Sanjana:540000,

Alok:360000, Nidhi:300000; Balance sheet Total-12,60,000

Sanjana will take Rs.50000 and Alok will bring Rs.200000

Question 6:

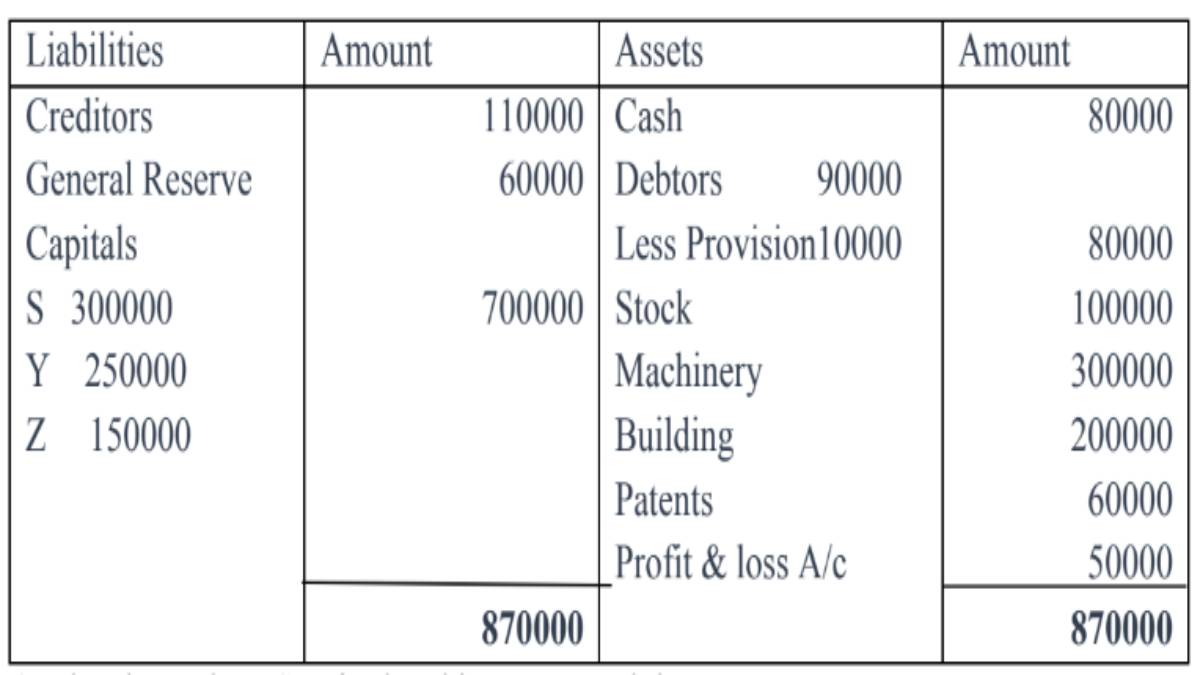

S Y and Z were partners in a firm sharing profits and losses in the ratio of 4:3:3. On 31st March 2016, their balance sheet was as follows:

On the above date, S retired and it was agreed that

a) Debtors of Rs 4000 will be written off as bad debts and a provision of 5% on debtors for bad and doubtful debts will be maintained

b) An unrecorded creditor of Rs 20000 will be recorded

c) Patents will be completely written off and 5% depreciation will be charged on stock, machinery and building

d) Y and Z will share future profits in the ratio 3:2

e) Goodwill of the firm on S’s retirement was valued at Rs 540000

Pass necessary journal entries for the above transaction in the book of firm on S ‘s

retirement.

Ans:

.jpg)

.jpg)

Question 7:

Read the following statement carefully and give the answer for the questions:

Shine Firework Ltd is authorised to issue shares 5,00,000 of ₹ 100 each. Company raised the capital by issue of 2,00,000 shares through e-IPO. As per the decision of Managing Board of Directors of company, company issued 75,000 shares to their parent company and 40,000 shares issued to existing employees of company as per their choice and option at the below price than the market price.

1. “Company issued 75,000 shares to their parent company” is an example of .

(a ) Public Issue

(b) Private Placement

(c) ESOP

(d) Issue other than cash

Ans:(b) Private Placement

2. “40,000 shares issued to existing employees of company as per their choice and option at the below price than the market price.” Is an example of

(a ) Public Issue

(b) Private Placement

(c) ESOP

(d) Issue other than cash

Ans: (c) ESOP

Question 8:

A company issued debentures of the face value Rs 10,00,000 at a discount of 6% on 1st April 2012. These debentures are redeemable by annual drawings of Rs 2,00,000 made on 31st march each year. The directors decided to write off discount based on debentures outstanding each year.

1) Amount of discount to be written off on 31st march 2013

(A) 20000

(B) 15000

(C) 25000

(D) 10000

Ans: (A) 20000

2) Amount of discount to be written off on 31st march 2014

(A)12000

(B) 14000

(C) 16000

(D) 18000

Ans: (C) 16000

3) Amount of discount to be written off on 31st march 2015

(A) 8000

(B) 10000

(C) 12000

(D) 14000

Ans: (C) 12000

4) Amount of discount to be written off on 31st march 2016

(A) 5000

(B) 6000

(C) 7000

(D) 8000

Ans: (D) 8000

Question 9:

Read the following case study and answer questions 18 to 22 on the basis of the

Same. Care Ltd is a company that deals in manufacturing of pharmaceutical products. Dev has recently been hired as an assistant to the accountant of Care Ltd. The accountant of the firm Mr. Raj asks Dev to go for financial statement analysis to assess the financial position of the firm. To judge the knowledge and capabilities of Dev, Mr. Raj asked him to analyze the financial statements from the view point various parties interested in the firm like the management, the lenders, the investors, government etc.

1. Which of the following statements will primarily be utilised by Dev for the purpose of financial statement analysis?

(a) Balance sheet and cash flow statement.

(b) statement of profit and loss and cash flow statement

(c) balance sheet and statement of profit and loss

(d) cash flow statement and fund flow statement.

Ans: (c) balance sheet and statement of profit and loss

2. If Dev is to analyse the financial statements for the top management, what should he consider?

a) Short-term liquidity of the firm.

b) Ability to pay its long-term lenders.

c) The resources of the firm are used most efficiently and that the firm’s financial condition is sound.

d) None of the above

Ans:c) The resources of the firm are used most efficiently and that the firm’s finan cial condition is sound.

3. If Dev is to analyse the financial statements for the investors, what should he consider?

a) Firm’s present and future profitability

b) Ability to pay its long-term lenders

c) Firm’s capital structure

d) Both (a) and (c)

Ans: d) Both (a) and (c)

4. While analysing the financial statements, Dev should be conscious of which of the following?

a) Changes in accounting policies of the firm

b) Personal judgements

c) Window dressing of financial statements

d) All of the above

Ans: d) All of the above

Question 10:

From the following information ,calculate the net cash flow from financing Activities

|

Particlars |

31- 3- 2020(Rs) |

31-3-2021(Rs) |

|

Equity Share Capital 9%Debentures Dividend Payable 10%Preference Share Capital |

10,00,000 1,50,000 ………….. 2,00,000 |

16,00,000 1,00,000 50,000 3,00,000 |

Additional Information

a) Interest paid on DebenturesRs.12,500

b) During the year2020-2021, the company issued bonus shares to equity shareholders in the ratio of 2:1 by capitalizing reserve.

c) The interim dividend of Rs.75,000 has been paid during the year.

d) 9%Debentures were redeemed as 5% premium.

e) Proposed equity dividend for the years ended 31/3/2020 and 31/3/2021 ended Rs.3,00,000 and Rs.1,50,000 respectively.

Ans: Cash Flow from Financing Activities

|

Particulars |

Amount` |

|

Proceeds from Issue of Equity Share Capital Proceeds from Issue of 10% Preference Share Capital Cash paid for Redemption of 9% Debentures (50,000 × 105%) Interest paid on Debentures Interim Dividend paid Final Dividend paid (3,00,000-50,000) |

1,00,000 1,00,000 (52,500) (12,500) (75,000) (2,50,000) |

|

Net Cash Used in Financing Activities) |

1,90,000 |

Important points to be noted in this problem

- Bonus shares worth Rs.5, 00,000 issued to equity shareholders are not to be shown in the cash flow statement because there is no flow of cash by this activity.

- Previous year proposed dividend-unpaid dividend =final dividend paid during the current year, is cash used in financing activities.

Also read: